Effective April 15, 2023, the Commonwealth Accounting Policies and Procedures (CAPP) Manual, which UMW’s SPCC Program must adhere to, changed the maximum allowable charge card fee percentage able to be charged by a supplier from 4% to 3%. The following provides guidance to Cardholders regarding how to handle charge card fees imposed by suppliers.

How to Verify Supplier Accepted Payment Methods

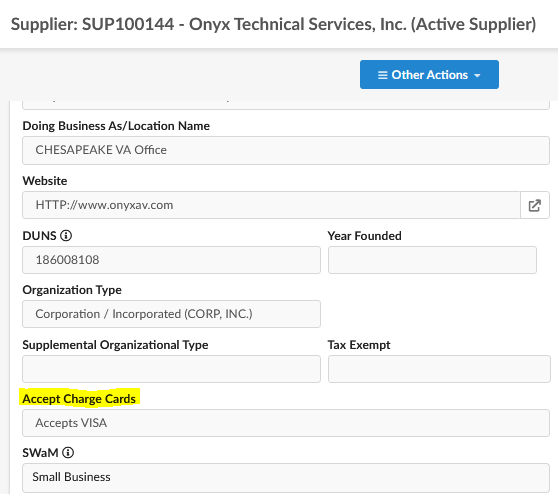

Prior to making a purchase, it is the responsibility of each Cardholder to understand the payment methods accepted and ordering procedures of the suppliers they use. One way to verify accepted payment methods is to review the supplier’s eVA profile:

- Using the Suppliers –> Browse Suppliers tab on the eVA dashboard, search for the supplier needed*. Once selected, click on the “Company Information” option on the left menu:

*Make sure the correct supplier is selected, especially if there are multiple entries. If you need assistance verifying if the supplier selected is correct, please contact TESS or Procurement Services.

- From here, scroll through the information until the “Accept Charge Cards” field. If the information says “Accepts VISA“, the supplier should accept the charge card.

- If there is any question as to whether the supplier actually does accept charge cards, the Cardholder should contact the supplier to determine payment methods accepted and confirm the following:

- if charge cards are accepted and, if so, are there any payment thresholds (i.e. they only accept charge cards up to $5,000)

- if there are any imposed fees for using the charge card and, if so, what they are.

Tip: If this is the first time the Cardholder is working with this particular supplier, it would also be helpful at this point to determine how they wish to accept orders from the University (i.e. via eVA directly, a print out of the purchase order and emailed to them, via their online website, over the phone, etc.)

- If the supplier’s eVA profile states they accept VISA charge cards, but discussion with the supplier confirms otherwise, the Cardholder should inform the supplier the need to change their eVA profile information to reflect accurate payment methods. Any assistance needed for supplier profile management should be directed to eVA Customer Care via the Supplier Assistance Request Form. The Cardholder must notate on their eVA order (if an eVA order is required) that the supplier does not actually accept charge card payments.

Charge Card Fee Requirements

The supplier must follow all the steps below in order to impose charge card fees:

- Supplier MUST disclose the amount of the surcharge using signs at the register or posted in location on Point of Sale (POS) system.

- Supplier MUST disclose the amount of the surcharge prior to online check-out.*

- Supplier MUST disclose the surcharge as a separate line item on the invoice or receipt.*

- Supplier MUST disclose the amount of the surcharge which can’t exceed more than 3%. If the fee is higher than 3%, continue reading the sections below for guidance.

- Supplier MUST process the surcharge and cost of goods/services as ONE transaction, not separately.

*IF a quote or invoice received from the supplier does NOT indicate a fee for using a charge card, they may not apply one at the time of payment. The Cardholder should inform the supplier that they will not pay the card fee as it was not disclosed prior to the purchase.

If assistance is needed with this situation, please contact your Program Administrators.

Charge Card Fees Imposed by Suppliers NOT ON Existing Contracts

If discussion with the supplier determines there’s an imposed credit card fee, or if the supplier’s quote/invoice indicates a fee will be charged for use of the credit card, and that fee is above the new maximum allowable 3%, follow these steps:

- Inform the supplier that as of April 15, the Commonwealth of Virginia lowered its allowable maximum credit card fee cap from 4% to 3% and request that the supplier lower its surcharge to this new maximum of 3%.

- If the supplier says “no” to lowering their imposed fee to 3%, proceed with the purchase at this time, if necessary, but inform the supplier that it may result in the University needing to seek alternative sources for the good/service being purchased in the future. Cardholders must contact the Program Administrators of any supplier who charges over a 3% surcharge. Suppliers that will not lower their surcharge fees may be reported to DOA by the SPCC Program Administrator.

Charge Card Fees Imposed by Suppliers ON Existing Contracts

If the Cardholder is purchasing from a supplier on an existing contract awarded prior to April 15 where a quote/invoice indicates an imposed credit card fee above 3%, the Cardholder may proceed with the purchase. If the Cardholder is unsure if the imposed fee is allowable, contact the Procurement Services Contract Officer for that contract.

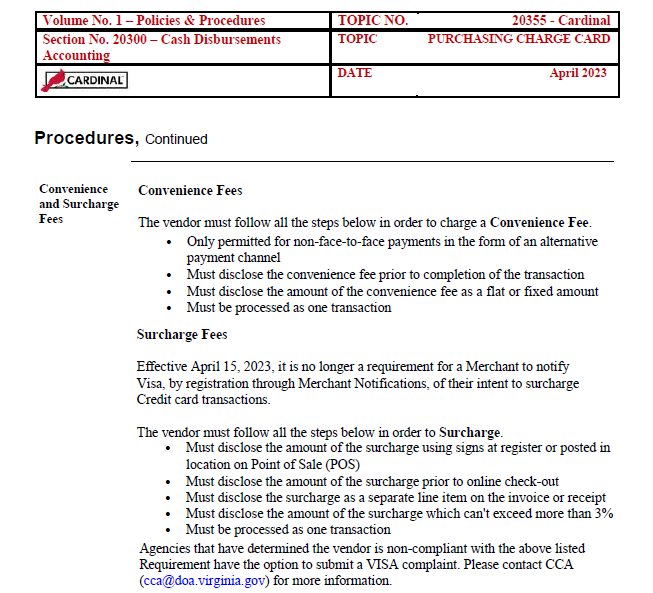

CAPP Manual Topic 20355: Surcharge Fees

If the supplier requires proof of the change in policy and/or the requirements regarding the ability to surcharge, feel free to send them this page directly from the CAPP Manual:

Resources

- CAPP Manual Topic 20355: https://www.doa.virginia.gov/reference/CAPP/CAPP_Topics_Cardinal/20355.pdf

- eVA Customer Care Suppler Assistance Request Form: https://dgs.virginia.gov/procurement/eva—virginias-eprocurement-portal/eva-customer-care-forms/supplier-hypercare-support-for-the-eva-transition/

- Cobblestone Public Contract Portal (Contract Officer Contacts): https://umw.cobblestonesystems.com/public/

- Program Administrator Contact Information:

- Michelle Pickham – mmiller8@umw.edu, 540-654-2260

- Lindsay Fare – lfare@umw.edu, 540-654-1057

Find MORE COOP contracts!

Find MORE COOP contracts!